Understanding the Global Dominance of the US Dollar

The US dollar’s status as the world’s primary currency is a complex interplay of historical, economic, and geopolitical factors. This blog explores why the dollar is a global currency, its implications for global trade, and how it shapes international relations.

The Historical Context of the Dollar’s Rise

After World War II, the US emerged as a dominant economic power. The Bretton Woods Agreement established the dollar as the world’s reserve currency, backed by gold. This agreement facilitated international trade and investment, solidifying the dollar’s role in the global economy and explaining why the dollar is a global currency.

The Bretton Woods system allowed other currencies to be pegged to the dollar, which was itself convertible to gold. This arrangement fostered confidence in the dollar and encouraged its widespread use in international transactions, underscoring why the dollar is a global currency.

The Role of the US Dollar in Global Trade

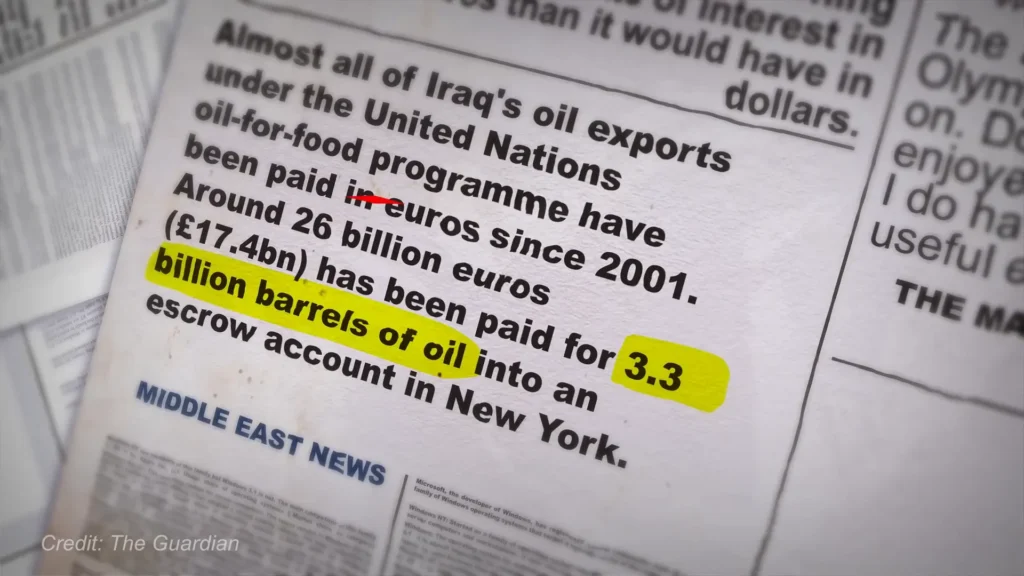

The dollar constitutes approximately 60% of global trade transactions. Its dominance is evident in various sectors, including oil, where transactions are predominantly conducted in dollars. This practice, known as “dollarization,” highlights why the dollar is a global currency and has significant implications for countries that primarily rely on the dollar for trade.

This reliance on the dollar can create vulnerabilities for countries that face economic sanctions or fluctuations in dollar value. For example, nations reliant on dollar-denominated debt may find it challenging to navigate international financial markets during periods of dollar strength, demonstrating why the dollar is a global currency.

Economic Sanctions and the Dollar

The ability to impose sanctions is a powerful tool for the US. Sanctions against countries like Iran and Libya have demonstrated how the dollar’s dominance can be weaponized, illustrating why the dollar is a global currency. By restricting access to the dollar, the US can significantly impact a nation’s economy.

These sanctions often lead to significant economic repercussions, as countries struggle to conduct trade without access to dollar transactions. The consequences can include hyperinflation, economic isolation, and increased reliance on alternative currencies, which further explains why the dollar is a global currency.

The Future of the Dollar

While the dollar currently holds a dominant position, there are emerging challenges. Countries such as China, Russia, and members of the BRICS group are exploring alternatives to dollar transactions. This shift may reduce the dollar’s influence in global trade and finance, but why the dollar is a global currency remains a significant factor in its enduring role.

As these nations seek to circumvent the dollar, the international monetary landscape could change dramatically. The rise of digital currencies and advancements in financial technology may also play a role in reshaping how currencies are used globally, impacting why the dollar is a global currency.

The Importance of Financial Markets

The stability and liquidity of US financial markets are crucial for the dollar’s dominance. The US Treasury market is the largest and most liquid in the world, making it an attractive option for both domestic and international investors, reinforcing why the dollar is a global currency. Additionally, the perception of the dollar as a “haven” currency bolsters its status. During times of economic uncertainty, investors flock to dollar-denominated assets, further solidifying why the dollar is a global currency.

Conclusion

The US dollar’s status as the world’s primary currency is a product of historical circumstances, economic policies, and geopolitical strategies. While challenges to its dominance are emerging, the dollar’s entrenched position in global trade and finance, and the understanding of why the dollar is a global currency, suggest it will continue to play a significant role in the foreseeable future.